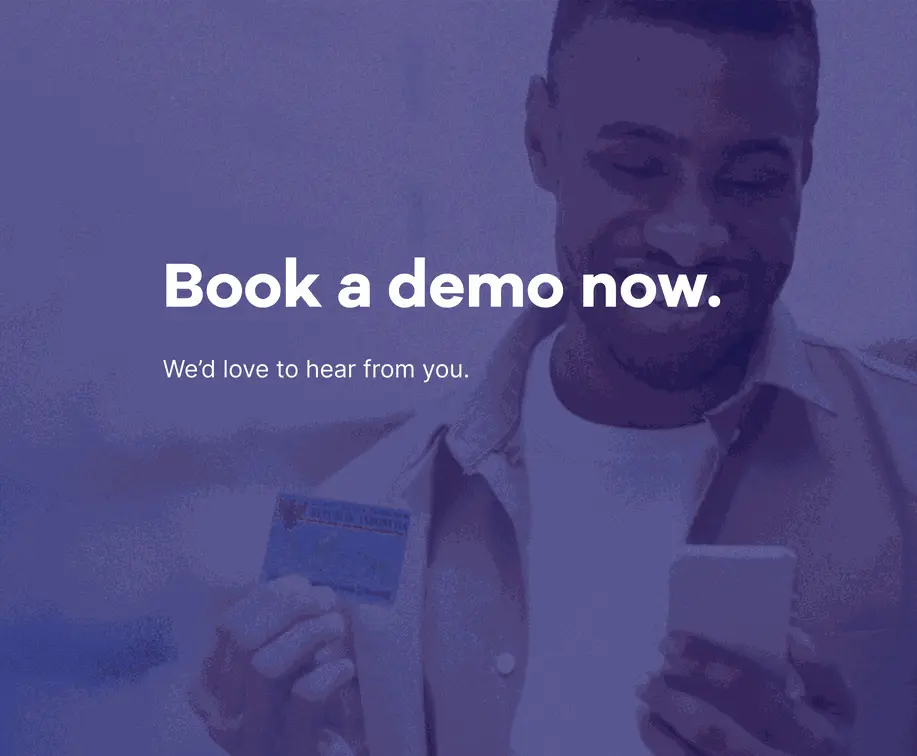

CUSTOMER-CENTRIC APPROACH IN ID AUTHENTICATION

In an era where security and efficiency are paramount, NFC technology emerges as a game-changer in chip-based document verification for the banking and financial sectors. Digibank Touchless ID Authentication (Digibank TIDA) is designed as a future-proof identity authentication solution, providing a top-notch user experience while minimizing cybersecurity risks throughout every phase of the digital identity management process

There are more than 2 billion NFC-enabled devices in use today

Catch the trend and lead the board with Digibank TIDA

- Extract and verify proper identity from diverse international and domestic ICAO 9303 ID documents in less than 15 seconds on average

- No margin of error in accessing, reading, and transmitting data while ensuring data privacy and protection

- Global support for different types of ID documents from different countries and territories

- TIDA is able to work with approximately 80% of all ever existed smartphones (1.6 billion) and all chip-based ID documents

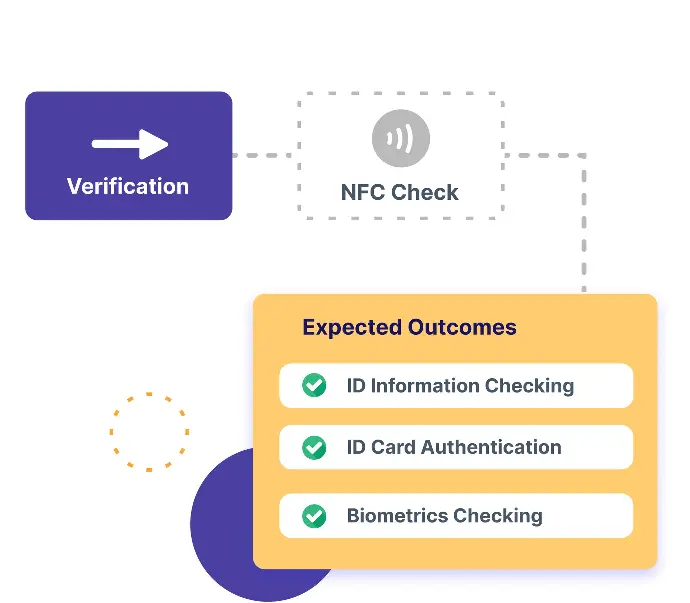

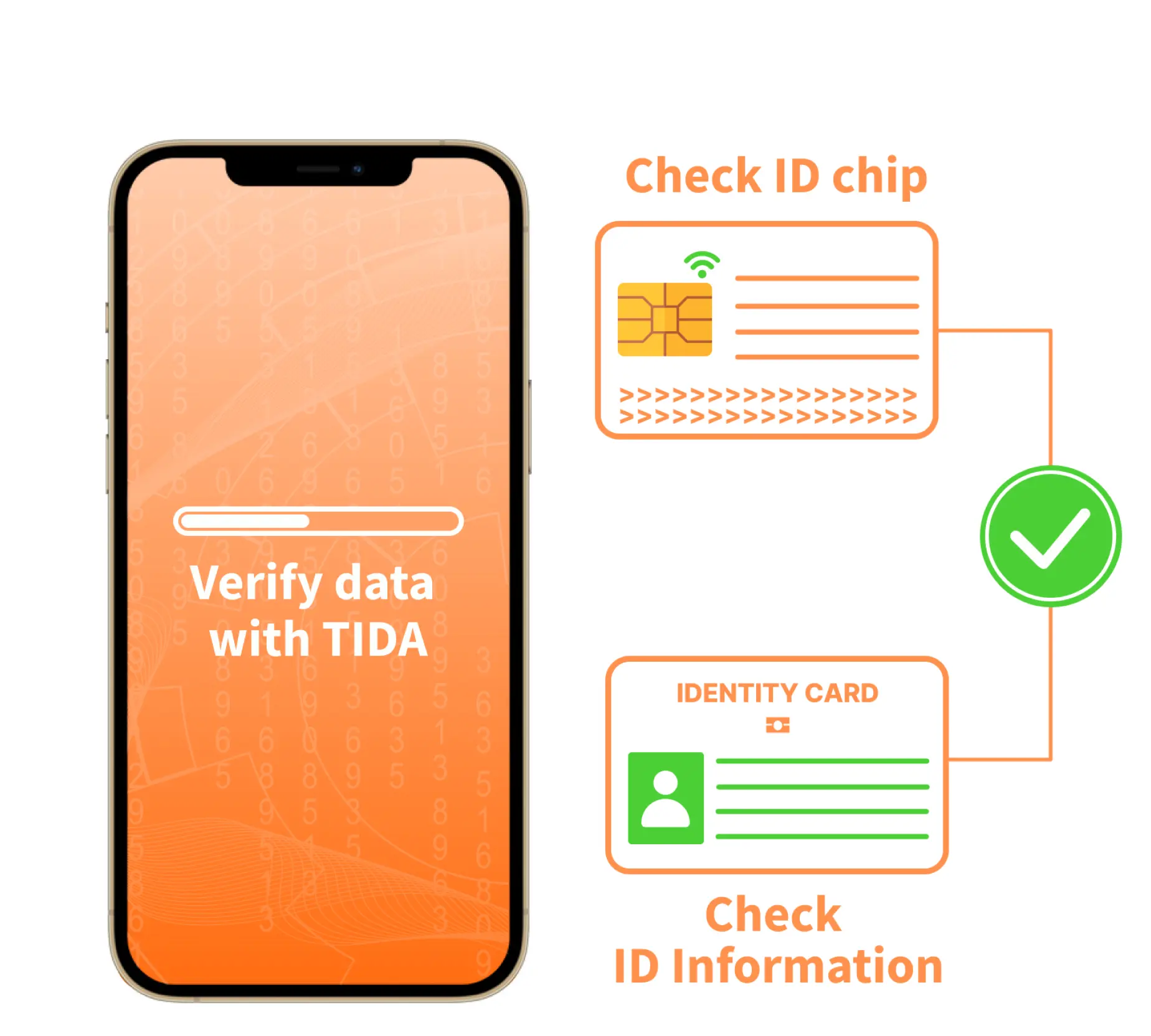

HOW TIDA WORKS?

1. Preparation

Customer taps the chip-based ID document against the smartphone

2. TIDA Verification

TIDA checks the legitimacy of the ID document and matches the data extracted from the chip against the document information

THE TRUSTED SOLUTION IN A DIGITAL WORLD

USE CASES

New Account Opening

Optimize remote user onboarding experience without the risk of forged documents

Loan/Credit Issuance

Simplify loan and mortgage approval processes by verifying the legitimacy of customers’ identities during submitting of the applications

Customer Due Diligence (CDD)

Avoid any form of financial crime, including money laundering, embezzlement, chargebacks, and account takeovers, to fully comply with CDD protocols