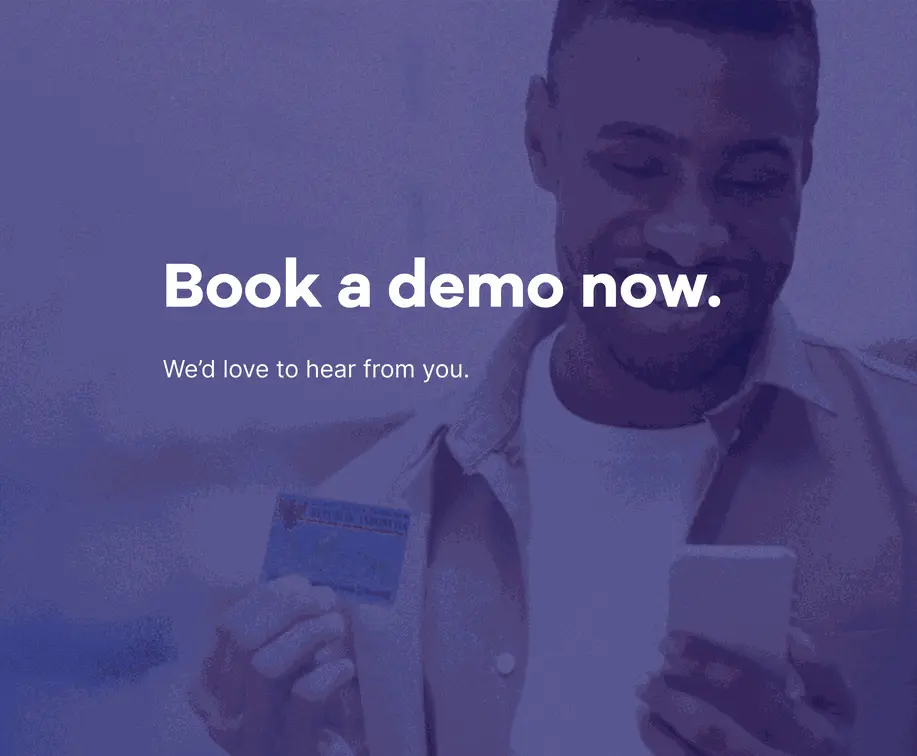

DIGITIZE IDENTITY VERIFICATION

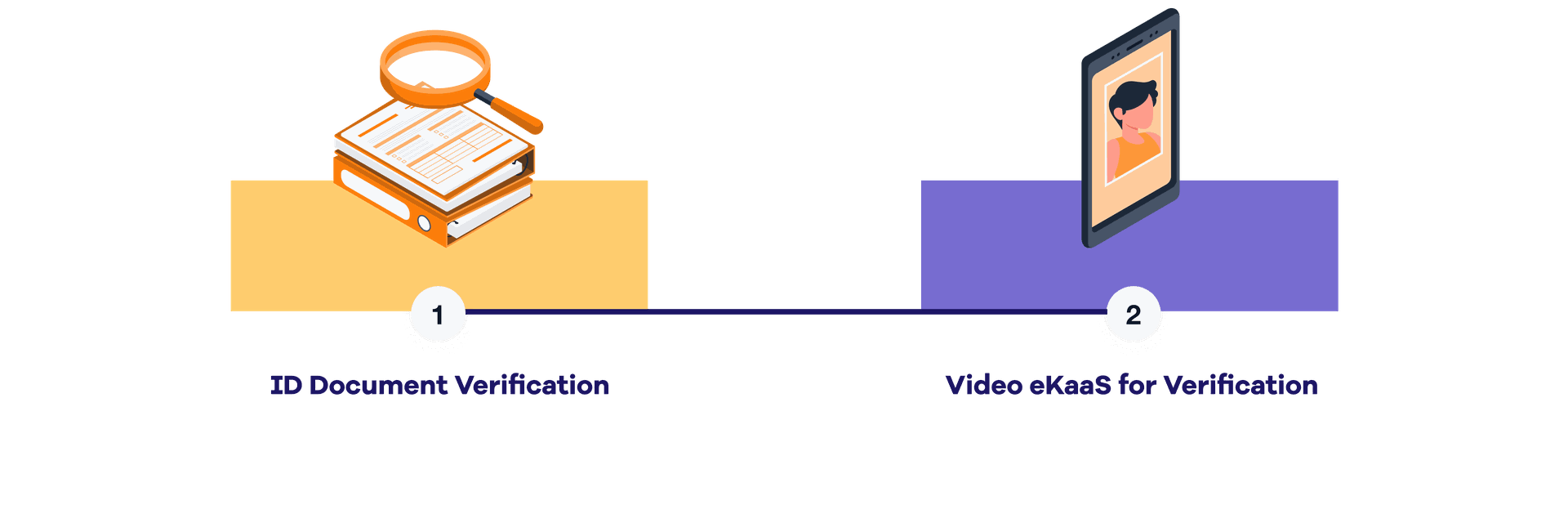

➊ Capture the ID document, extract the data, verify and authenticate the data through a multi-layer authentication process in seconds

➋ Employ unique biological traits (face and voice) to confirm the legitimacy of customers

DOCUMENT VERIFICATION AT EASE

Experience a swift and flawless document verification with quality guaranteed

Our AI-powered document verification system captures, reads and cross-checks data from any government-issued identity document instantly and easily detects fraud attempts:

Ensure Accuracy

Ensure accuracy of information extracted from ID documents by 3-layer authentication process: OCR, Fraud Check and Blacklist scanning, even in low-light condition

Detect Fraud Immediately

Detect fraud immediately in the first step of verification by Advanced Doc Fraud Check & Forensics using AI, machine learning and expertise in field

Use with Ease

User-friendly and rapid user validation confirmation via capture and comparison of ID document within seconds:

- Authenticate a variety of identity documents in multiple languages

- Effective compliance and fraud protection

VIDEO-BASED MULTIMODAL BIOMETRIC

FOR STRONGER VERIFICATION

Keep good guys in, bad guys out

Digibank provides a powerful and accurate biometric recognition match and behavior check.

This is built on NIST benchmark through an integrated single-frame video without any additional required from users:

A NEW LEVEL OF EFFICIENCT AND SECURITY

The adoption of video-based biometric for customer verification is poised to play a pivotal role in the financial landscape,

with higher accuracy, and robust security measures with the same technical/legal security as in-person verification in branches

USE CASES

Account Recovery

Simplify and secure account recovery process, deter illegitimate factors, and allow users to regain access by authenticating their identity

New Account Opening

Provide a quick, secure and user-friendly onboarding experience through mobile app and screen against cumulated blacklists over years, reducing the chances of complex fraud attacks

Loan/Credit Issuance

Minimize time spent on paperwork, automate the approval of loan or credit processes for legitimate borrowers, and prevent financial fraud risks with the help of AI and biometric checks

Customer Due Diligence (CDD)

Enhance due diligence measures for high-risk or highly suspicious customers on an ongoing basis by providing trusted evidences along with adhere to CDD requirements over the entire customer lifecycle