FROM FASTER ONBOARDING TO HEIGHTENED TRUST

Realizing enterprises' purpose of reaching millions of legit users

Empathetic UX

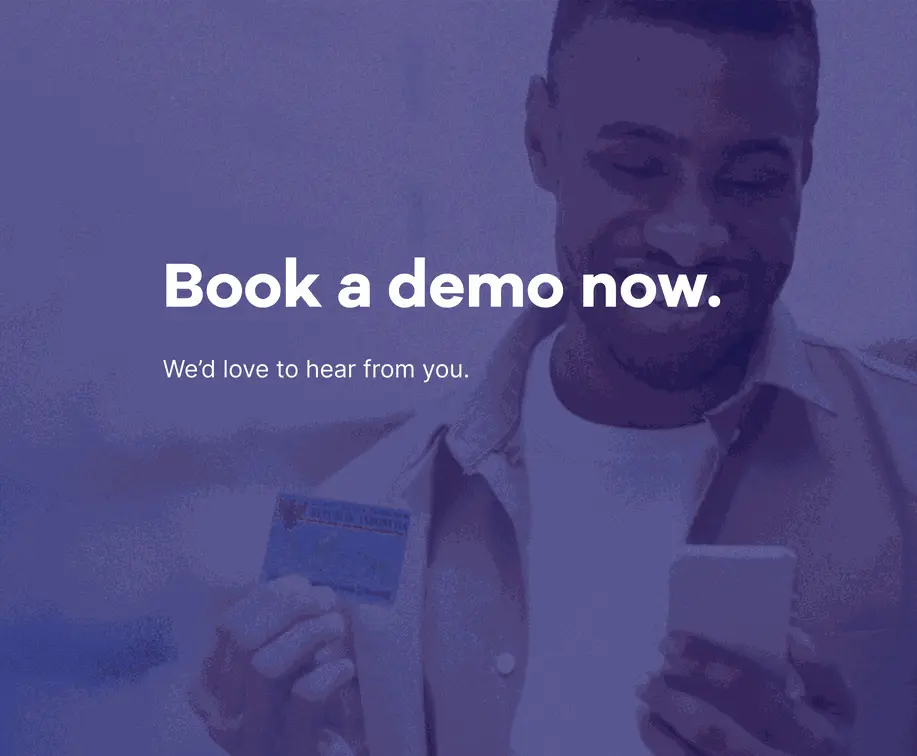

It takes less than 01 minute on average to complete the eKYC process. We provide an easy-to-use, swift, and frictionless onboarding experience, saving valuable time and providing a competitive edge in user satisfaction

Reliability Assured

Digibank protects businesses from fraud through layered biometric technologies and sophisticated anti-spoofing techniques, without limiting the number of users performing eKYC

High Scalability

Our system serves more than 1 million API requests per day and continues to scale efficiently to provide uninterrupted service for a rapidly expanding user base

Legal Compliance

Digibank offers full process assurance, ensuring compliance with KYC, AML, and personal data protection requirements across multiple countries, providing businesses with a comprehensive solution for regulatory compliance

Global Coverage

Our global reach extends to a multitude of regions and languages worldwide, enabling you to seamlessly verify identities across diverse geographic and linguistic boundaries

Cost-Effective

Digibank provides both automatic and semi-automatic process for OCR, KYC, CDD and AML monitoring, reducing manual labor, and minimizing the risk of errors or compliance-related fines

UNLOCKING THE POTENTIAL OF EKAAS

Digibank offers you the chance to create a customized eKaaS platform

with a fully customized customer onboarding workflow that aligns with your specific business requirements

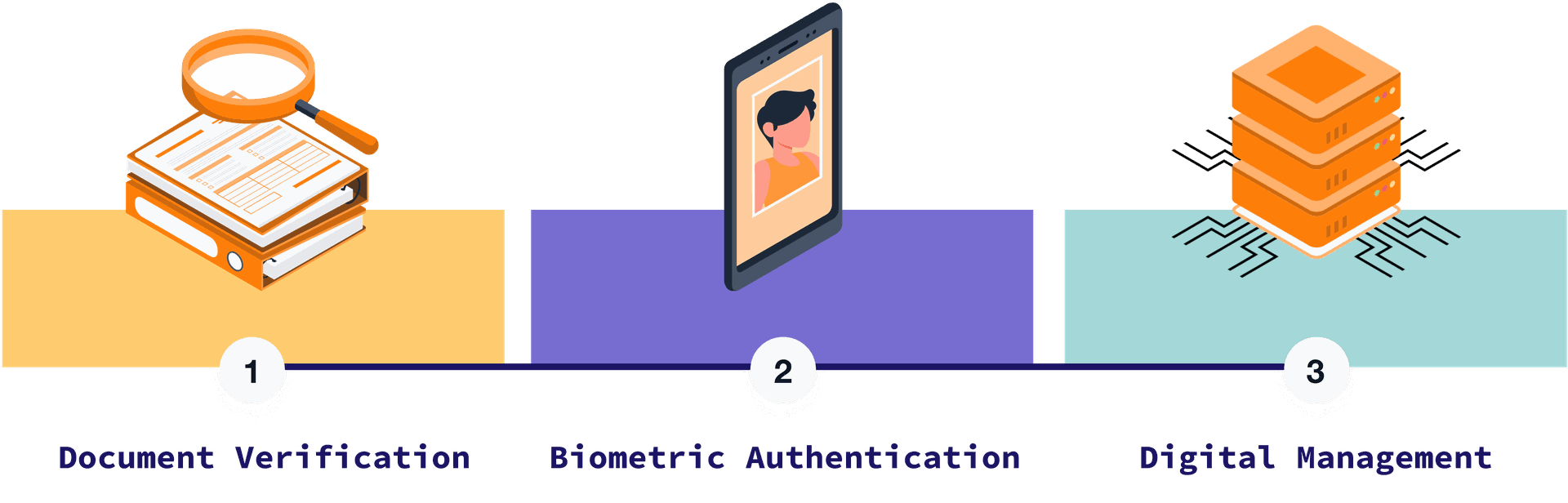

DOCUMENT VERIFICATION

More than recognition and extraction data from ID documents, Digibank's technology can detect the legacy with images of ID documents in the early phase

A feature-rich approach with NFC verification for any chip-based ID documents to automatically detect and compare data with authentic national registration data records

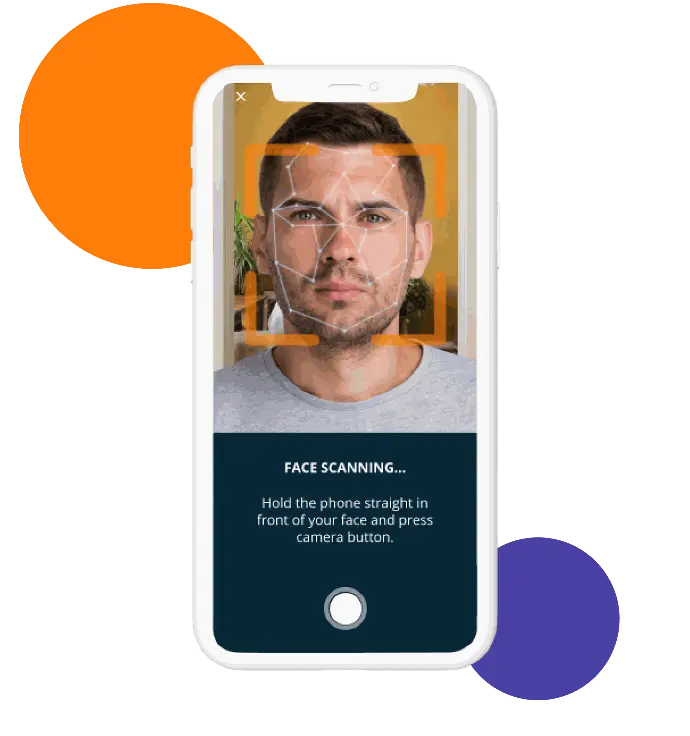

BIOMETRIC AUTHENTICATION

Fast video-based Biometric Verification with multimodal biometric check to ensure the accurate matching of document holder identities

An End-to-end video call between users and service agents provides non-repudiated verification for high-value services, which fosters long-term and sustainable growth in customer relationships

WHY CHOOSE DIGIBANK?

Continuously growing

By consistently monitoring and optimizing the system after the implementaTion of eKYC, Digibank ensure that it remains aligned with evolving requirements and delivers optimal results for both our customers and end-users

Customer-centric View

By paying attention to designing intuitive and user-friendly interfaces for users, we simplify the onboarding process, reduce the number of steps required, and provide clear instructions and guidance at every stage while remain the robust security measures

Proven Bank-grade trust

Our technologies are trusted by top banks in Asia, offering high availability, the strong level of security to to safeguard your sensitive data

INDUSTRIES CAN BE APPLIED

Banking & Financial Services

Enhance customer onboarding and identity verification processes, enable secure and convenient account opening, loan applications and transactions

Travel & Hospitality

Streamline guest check-in, reservation, and loyalty program enrollment through a hassle-free and personalized experience for travelers

Healthcare

Enable quick and accurate patient identification and data management to improve healthcare delivery and patient privacy

Retails

Expedite in-store and online shopping experiences through efficient and secure transactions while enhancing customer trust

Gaming & Gambling

Enhance player safety and compliance by ensuring identity confirmation for a responsible and enjoyable gaming experience